31+ using 401k to pay off mortgage

For example if you have 1 million in. Web Your income will probably be subject to a 22 federal tax rate and your federal tax bill will be around 9500.

:max_bytes(150000):strip_icc()/picture-53894-1440689455-5bfc2a8846e0fb00260af532.jpg)

Using Your 401 K To Pay Off A Mortgage

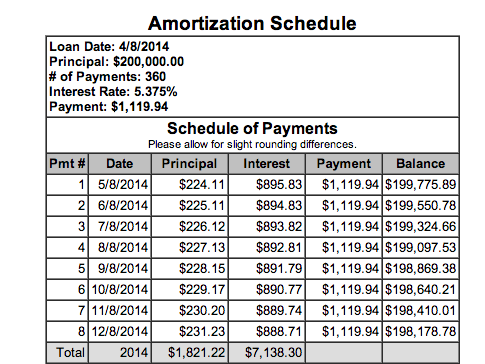

Web If you take 300000 out to pay off your mortgage your annual growth will go from 70000 down to 49000.

. Web The question is whether they should stop contributing 1500 per year each to their 401 k plans and instead use these funds to pre-pay their mortgage. Web Of course there are a couple of immediate benefits to paying off a mortgage. Web Clarks Take on Whether You Should Withdraw Funds From Your 401k To Pay Off Your Mortgage Clark says.

But what if you withdraw 150000. You can borrow the lesser of either. You might be able to comfortably pay your mortgage during retirement.

Web Cashing out your 401 k and using the proceeds to pay off your mortgage lets you borrow at a low rate and invest at a high rate and do so at no risk. Web Its an absolutely horrible way for a 40-something-year-old to pay off a mortgage while still working and earning because you get none of the tax advantages. Your monthly obligations drop and you may get more wiggle room in your.

Web Generally if you are under age 59 12 you must not only add this to your gross income but also pay a 10 percent additional tax on your early distribution. Web There are ways to pay off your mortgage loan much sooner including by applying money to your loan youd normally put in your 401 k retirement account. Making a larger down payment made possible by a 401k loan can allow you to borrow from a wider.

By taking a loan from a 401k you can pay off your mortgage and avoide the income tax then increase. Pros of Paying Off Your Mortgage with Your 401k. Web You may be able to get a better deal on your mortgage.

If your home doesnt. We are working on our. You have to show that youve been economically.

Web If your 401 k is reliably delivering a 7 rate of return you should think before touching it. Web If you have a personal finance question for Washington Post columnist Michelle Singletary please call 1-855-ASK-POST 1-855-275-7678 I am 60 years old. Web You might pay roughly 2692 in federal income tax.

Web The first option for using a 401 k to purchase a home is borrowing from your account. Web Using the money from your 401 k to pay off your mortgage normally only results in a return on investment tied to your propertys appreciation in value. The standard LTA is currently 1073100 frozen at this level until tax year.

Web Doing so now may protect against further interest rate hikes but fees are costly. That rate of return is free money. Web We paid off our mortgage using the money that remained after taxes on that 180000.

I will be rolling the rest of that 401k into an IRA. 10000 or half your vested account. But if your 401 k withdrawal doubles your annual.

Web Using Your 401k to Pay Off Mortgage Without Incurring Taxes - YouTube.

How We Saved And Invested Over 100k In 2019 The Minted Latte

Why You Shouldn T Use Your 401 K To Pay Off A Mortgage

My Guide To Hedgefundie S Portfolio And Why I M 100 Invested In It For Fatfire And Whalefire R Financialindependence

Should I Use My 401 K To Pay Off My Mortgage 5 Things To Consider Principal Com

Paying Off My Mortgage Vs Investing In My 401 K

Should You Pay Your Mortgage Off Early Calculator Included Young Dumb And Not Broke

Should I Use My 401 K To Payoff Mortgage When To Use 401 K To Payoff Mortgage If Retired Youtube

Can You Make Extra Payments On A 401 K Loan To Pay It Off Faster

Calameo October 11 2016 Edition

Should I Use My 401 K To Payoff Mortgage When To Use 401 K To Payoff Mortgage If Retired Youtube

How To Become A 401 K Millionaire

Why You Shouldn T Use Your 401 K To Pay Off A Mortgage

Should I Use My 401 K To Payoff Mortgage When To Use 401 K To Payoff Mortgage If Retired Youtube

![]()

Start A Baskin Robbins Franchise In 2023 Entrepreneur

401k Plan Loan And Withdrawal 401khelpcenter Com

Should You Pay Off Your Mortgage Or Invest The Cash

Invest For Retirement Or Pay Down Mortgage Debt Financial Samurai

Komentar

Posting Komentar