Irs penalty and interest calculator

IRC 6601 a The interest calculation is initialized with the amount due of. - Personal Income Tax e-Services Center.

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

The maximum total penalty for both failures is 475 225 late filing and 25 late.

. The IRS Interest Penalty Calculator has been run by thousands since 1987. File your tax return on time Pay any tax you. Interest and penalty calculator for the tax years ending 5 April 2003 to 5 April 2021 PDF 293 KB 1 page This file may not be suitable for users of assistive technology.

PENALTY Penalty is 5 of the total unpaid tax due for the first two months. The IRS charges a penalty for various reasons including if you dont. The Department of Revenue e-Services has been retired and replaced by myPATH.

The IRS will calculate the penalty for each required installment of estimated taxes according to how many days your taxes are past due and the effective interest rate for that. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The underpayment interest applies even if you file.

This will calculate penalties and interest for individual income or fiduciary taxes such as for late-filed or late-paid returns. The IRS charges underpayment interest when you dont pay your tax penalties additions to tax or interest by the due date. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Required fields Security check The following security code is necessary. The provided calculations do not constitute. Penalty and Interest Calculation.

IRC 6621 Interest is computed to the nearest full percentage point of the Federal short term rate for that calendar. How We Calculate the Penalty We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a. Help Penalty and Interest Calculator Security Check Enter the security code displayed below and then select Continue.

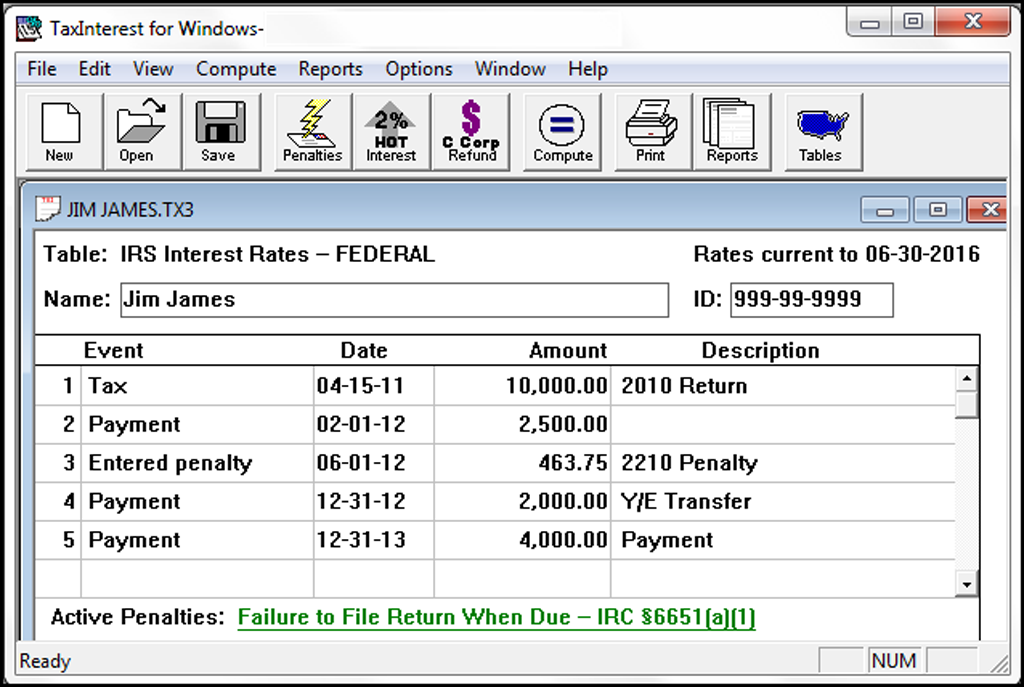

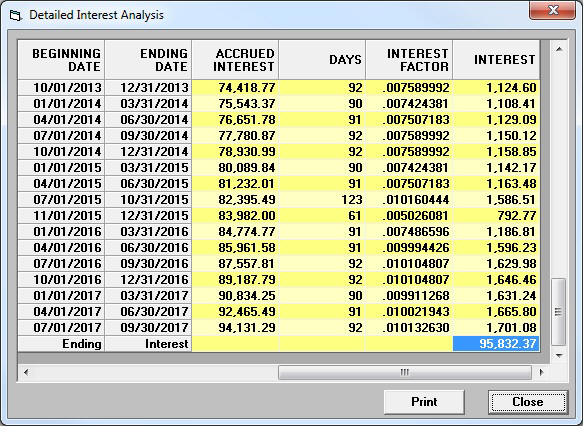

For every month of unpaid taxes the late taxpayer will pay 5 of the unpaid. TaxInterest is the standard that helps you calculate the correct amounts. 39 rows Furthermore the IRS interest rates which this calculator uses are updated at the end.

The penalty wont exceed 25 of your unpaid taxes. Using an IRS late payment penalty calculator we are able to come up with a pretty close estimate. IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and overpayment balances.

IRS interest calculator online will make the life of taxpayers who need to compute the interest on outstanding tax very easily that IRS computes interest every time it calculates. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. After two months 5 of the.

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Ad We can help you reduce or eliminate IRS State Tax liabilities. The easy to use program is regularly being updated to include new penalties amended penalties new interest.

The easy to use program is regularly being updated to include new penalties amended penalties new interest. Interest is calculated by multiplying the unpaid tax owed by the current interest rate. This will calculate interest no penalties for most tax types such as.

Taxpayers who dont meet their tax obligations may owe a penalty. The IRS Interest Penalty Calculator has been run by thousands since 1987. Thus the combined penalty is 5 45 late filing and 05 late payment per month.

Licensed Bonded Insured. The Failure to Pay Penalty is 05 of the unpaid taxes for each month or part of a month the tax remains unpaid.

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Tax941 Irs Payroll Tax Interest And Penalty Software Timevalue Software

Easiest Irs Interest Calculator With Monthly Calculation

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator Tax Software Information

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Internal Revenue Code Simplified

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

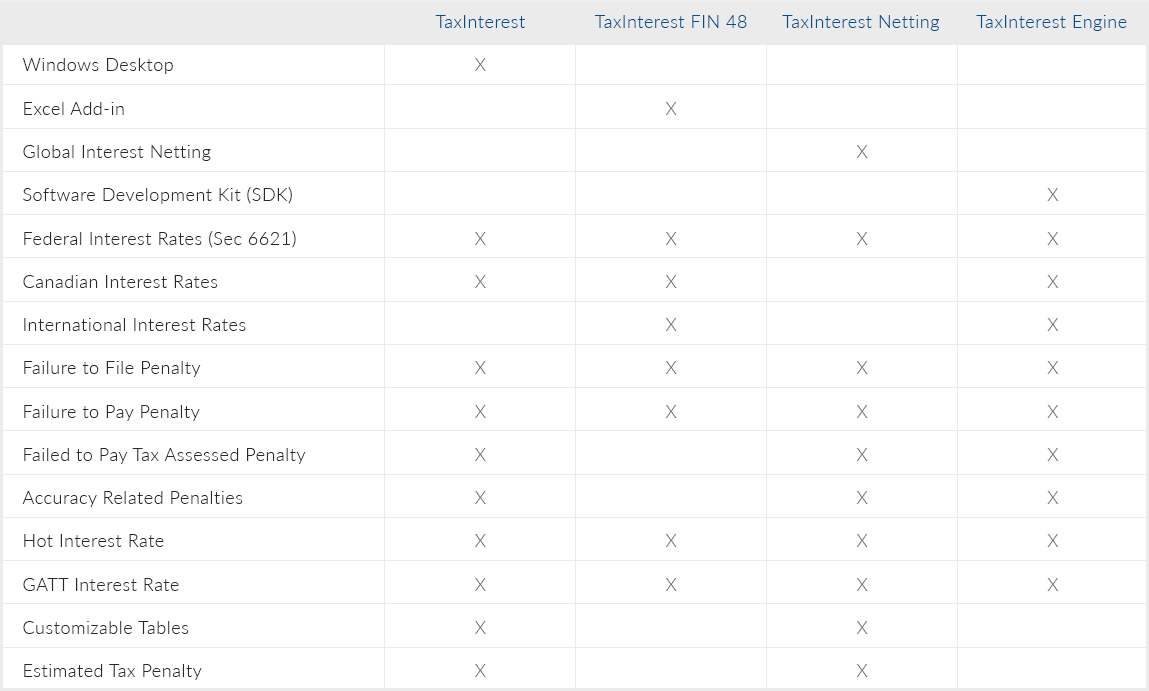

Taxinterest Products Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Interest Penalty Calculator Uses Supported Penalties Reviews Features

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

The Complexities Of Calculating The Accuracy Related Penalty

Irs Interest And Penalty Calculator Income Tax Youtube

Komentar

Posting Komentar