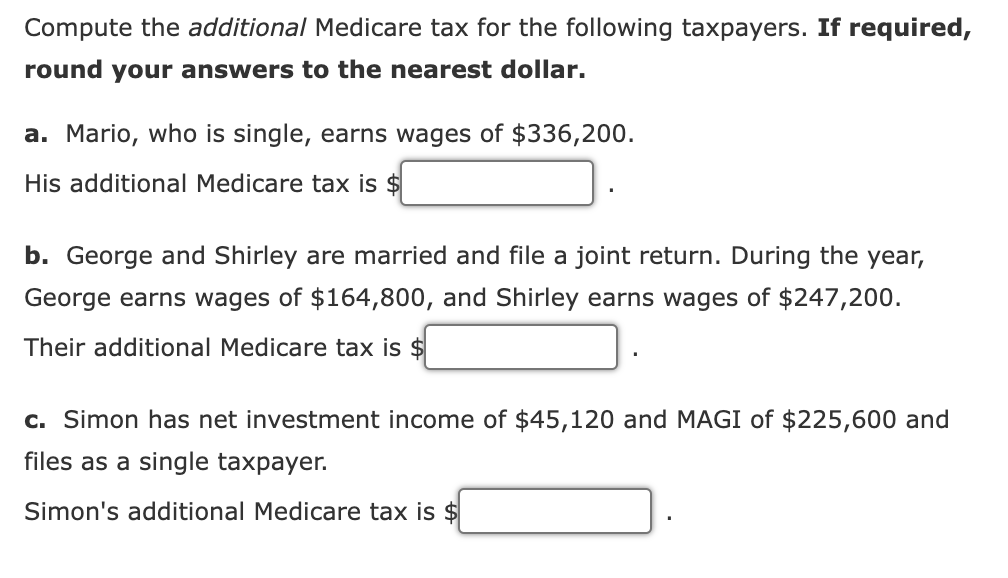

Calculate additional medicare tax

560 Additional Medicare Tax. Web An employee will pay 145 standard Medicare tax plus the 09 additional Medicare tax for a total of 235 of their income.

Solved In 2021 Bianca Earned A Salary Of 164 000 From Her Chegg Com

Web Information about Form 8959 Additional Medicare Tax including recent updates related forms and instructions on how to file.

. Web Topic No. The FICA withholding for the Medicare deduction is 145 while the Social Security withholding is 62. Unlike the additional Medicare tax there is no base limit on wage so all wages are subject to.

Normal medicare tax rate for individual is 145 of gross wages or salary. This is the amount youll see come out of your paycheck and its matched with an. For both of them the current Social Security and Medicare tax rates are 62 and 145 respectively.

Web Whats The Current Medicare Tax Rate. Web Standard Medicare tax is 145 or 29 if you are self-employed. Web Jan 15 2022 FICA taxes include both the Social Security Administration tax rate of 62 and the Medicare tax rate.

So each party pays. In addition to withholding Medicare tax at 145 you must withhold a 09 Additional. Perfect answer Based on the Additional Medicare Tax law all income for an individual above 200000 is subject to.

Thus the total FICA tax rate is 765. You must combine wages and self-employment income to determine if your. Web How To Calculate Additional Medicare Tax Properly Additional Medicare Tax Example.

What is the additional Medicare tax rate for 2020. Web How do you calculate FICA and Medicare tax 2021. Web Step 1.

Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status without regard to whether any tax was withheld. Web Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status without regard to whether any tax was withheld. Web Employers and employees split the tax.

A person who is self-employed will pay. A 09 Additional Medicare Tax applies to Medicare wages self-employment income and railroad retirement RRTA. Web How To Calculate Additional Medicare Tax 2019.

The FICA tax rate which is the combined Social Security rate of 62 percent and the Medicare rate of 145. Web Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status without regard to whether any tax was withheld. Normal medicare tax rate for self employed person is.

In 2021 the Medicare tax rate is 145. The Additional Medicare Tax remains in place for the upcoming calendar year. Web How to calculate additional Medicare tax properly.

Web The additional 09 Medicare tax applies to net SE income over 200000 for unmarried individuals 125000 for married separate filers and combined net SE income above. Use this form to figure the amount.

Aca Tax Law Changes For Higher Income Taxpayers Taxact

Solved W2 Box 1 Not Calculating Correctly

How To Calculate Additional Medicare Tax Properly

How To Complete Irs Form 8959 Additional Medicare Tax Youtube

What Is Medicare Tax Definitions Rates And Calculations Valuepenguin

Additional Medicare Tax Calculator With How Why What Explanation Internal Revenue Code Simplified

Additional Medicare Tax Detailed Overview

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

What Is And How To Calculate Fica Taxes Explained Social Security Taxes And Medicare Taxes Youtube

3 Types Of Medicare Tax Break Down Example In Golden Years Moneytree Software

How To Calculate Additional Medicare Tax Properly

2

Additional Medicare Tax H R Block

How To Calculate Additional Medicare Tax Properly

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Additional Medicare Tax Detailed Overview

How To Calculate Additional Medicare Tax Properly

Komentar

Posting Komentar